In amid of COVID-19, as a part of social distancing people are less likely to do currency transactions by hand and hence the Digital payment and online banking have been increased disruptively. Almost everyone with a smartphone on hand has linked their bank account to websites, online stores, and apps to ease their needs. This has been taken as a big opportunity by scammers who steal money online. As from reports, most of the scammers do identity theft, they impersonate and claims to be one of the representatives from the website, app, or even bank which has a lead to you. These frauds collect your mobile/phone number from online sources and calls repeatedly to put you in trouble. They ask for your credit card details and other sensitive information as in the name of confirmation and renewals. If you ever convinced and reveals the information demanded, that's it! You have been compromised.

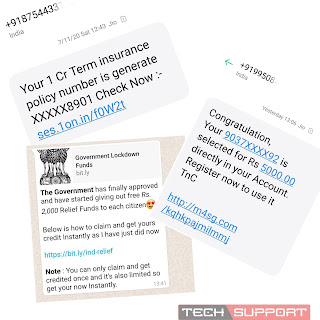

Now, Let's take a quick look over the prone vulnerabilities hidden on the internet. Firstly, by doing transactions or payment in unauthorized online stores and websites. By clicking on external links sent via emails or SMS, these so-called scammers or hackers offer you free subscriptions, trail packs, cashback, games with rewards, gift cards, and even fake job alerts. However, due to these pandemic situations, many of the people lose their job and are continuously searching for a new one as it is the need of the hour. In the wake of it, an increasing number of instance fake job offers are spammed around the web and asking for money(mostly refundable). Thus, by clicking on such links it can redirect you to some other unauthorized replicated websites created by scammers which collects your highly credential credit/debit card information even before you realize it was a fake website.

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so. – Mark Twain

Almost every authorized organization on the internet is continuously working to track, prevent such scams, and putting a lot of effort to give flawless awareness to their trusted customers or users about these cyber frauds happening around. In this context, no such organizations will ever ask your sensitive data via call, email, or through any means.

What should you do?

>You are responsible

RBI (Reserve Bank of India) has set up 2 step verification process for every transaction made that are valid only in national boundaries. One such verification process is called OTP (One time password) where you have to enter the password that has sent to your registered email ID or mobile number which will grant access for the transaction to complete. Almost 99% of the people who lose money online unknowingly share their OTP to a second person. You should never ever share your OTP to anybody. Even Banks or cyber cell wing are helpless in this case as you are the only one responsible. In general, It is the only key that can be kept away from the online thefts.

But, there is a catch. RBI has its own rules and regulations valid only in its domestic transactions. If you are doing international payments such as purchasing products from aliexpress (not Indian) for example, they don't have to follow the 2 step verification or OTP. So before doing so, It's completely up to you to check whether it is secure or not.

> Be more vigilant.

Don't be a clickbait. Its a trap. There are a lot of frauds on the internet who are waiting to steal your money by phishing, so avoid visiting unauthorized websites and fill personal identifiable information. You have to pay more attention to the website URL before moving on. A secured website can be identified by its URL where it begins with https along with a green lock. Still, https is not enough!

> Thief in your home.

In India, a 16-year-old boy spent ₹16 lakhs (around $ 22k)from his parent's account and used it for in-App purchases to play PUBG. He deleted the transaction details sent from the bank and so his parents were unaware of that for too long. They provided him with a smartphone only to attend online classes but unfortunately, their account has been vanished due to their negligence.

Parents must turn on the parental control mode before handing your phone to the child. This can save your accounts from accidental errors and mischiefs.

> Other precautions

- Avoid transactions while you are connected to a public WiFi. It's highly prone to vulnerable as many other shares the same network. Hackers can send malicious content to your phone and can collect your private information. Use premium anti-virus software which can protect your phone or system from malware attacks.

- Installing apps from unauthorized sources is also dangerous as they might contain pre-installed codes that can act as a spy. Every app needs permission from the user to access the details from the phone, so grant permission wisely.

- If you are doing transaction activities from an unknown device then strictly use incognito mode in browsers that safeguard user data from the main session. Also, change your passwords frequently and put a strong password which cannot be guessed easily.

- Set a day transaction limit for the bank account which can help you to cut severe losses when compromised. So that your entire hard-earned capital won't be wiped out in a blink of a second.

Conclusion

Even after following all the precautionary methods mentioned and you still find any fraudulent activities around, then report immediately to your bank office (if it is related to the bank) and file complaint to the cybercrime department in your jurisdiction at the earliest.

Always remember! This isn't enough, Your privacy cannot be secured completely. Few days back, Twitter profiles of famous figures such as Bill Gates, Barrack Obama, Jeff bezos, Elon Musk, Warren Buffet etc were hacked for bitcoin scam. Therefore, Security breach can happen anywhere and at anytime. Hackers are superior, they are always one step ahead of others. Lets hope you and I are not their targets!

Security is just an illusion..and privacy is a myth!

-min.png)

0 Comments